The U.S. Consumer Price Index (CPI) data for July 2025, released on August 12 by the Bureau of Labor Statistics, offers fresh insight into the state of inflation in America. While headline inflation held steady, core inflation ticked slightly higher, signaling that price pressures remain persistent in certain sectors. This month’s report comes at a critical time for consumers, policymakers, and investors, all watching closely for signs of whether inflation is firmly under control or if additional policy action may be needed.

1. Headline and Core Inflation at a Glance

Headline CPI rose 0.2% month-over-month in July, matching economists’ expectations. On a year-over-year basis, prices increased 2.7%, unchanged from June’s pace and slightly below the 2.8% forecast. (Fox Business)

Core CPI—which excludes volatile food and energy prices—rose 0.3% for the month and 3.1% year-over-year. This was the fastest monthly increase in core prices since January, suggesting that underlying inflationary pressures have not fully eased despite broader improvements in headline figures. (CNBC)

2. What’s Driving Inflation?

Price movements in July were shaped by a mix of cooling and heating sectors:

- Shelter costs rose 0.2%, continuing their role as one of the most significant contributors to core inflation. Housing-related inflation remains stubbornly high, despite signs of slowing rent growth earlier this year.

- Food prices were unchanged overall. Grocery costs fell 0.1%, thanks to declines in categories like dairy and produce, but restaurant and dining-out prices increased 0.3%, driven by higher labor and operating costs in the hospitality sector.

- Energy prices fell 1.1% in July, led by a 2.2% drop in gasoline. Over the past year, gasoline prices are down nearly 10%, providing some relief to households facing elevated costs elsewhere.

- Services such as airline fares, medical care, and recreation saw noticeable price increases, adding to the upward pressure on the core index.

3. Tariffs and Market Sentiment

Trade-related costs also played a role in this month’s inflation reading. Prices for tariff-sensitive goods like furniture and tires edged higher, reflecting the impact of recently imposed import duties. Economists caution that while these tariff effects may be temporary, they can still influence short-term inflation trends. (New York Times)

Financial markets responded positively to the report. The steady headline figure and manageable core increase were enough to boost investor confidence, with major stock indices climbing and bond yields dipping. Traders are increasingly betting that the Federal Reserve could move toward a rate cut in September, though analysts warn that such a decision will hinge on further data, particularly labor market and wage growth numbers.

4. How This Compares to Recent Trends

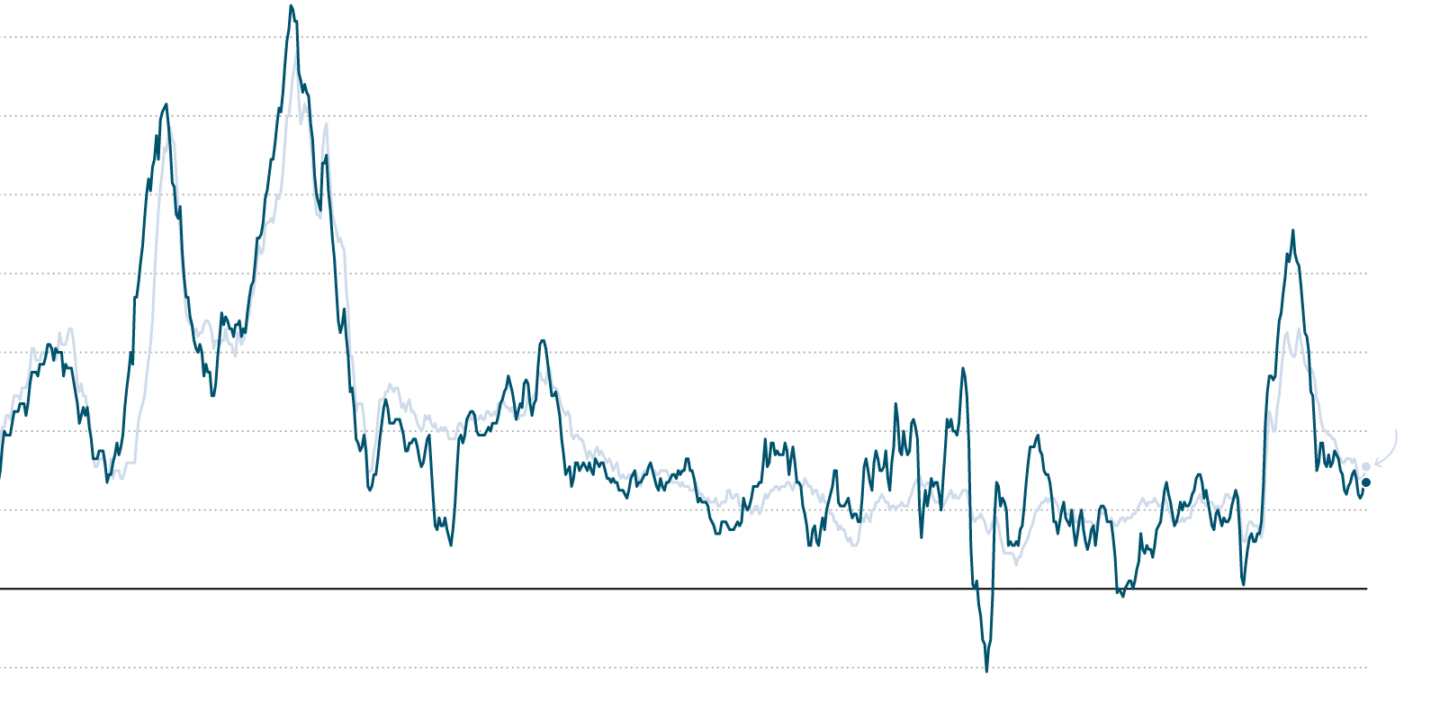

July’s inflation report fits within a broader pattern of gradual improvement in headline figures since mid-2024. However, the persistence of elevated core inflation mirrors a challenge seen in the post-pandemic economy: prices for essential services and housing are proving slower to adjust than those for goods and energy.

Compared to the inflation peaks of 2022, when year-over-year CPI surged above 9%, the current 2.7% rate represents significant progress. Still, the Fed’s 2% target remains just out of reach, and policymakers are mindful of avoiding a premature declaration of victory over inflation.

5. What It Means for Consumers

For households, the July CPI report delivers a mixed message. Declining gasoline and grocery costs provide relief at the margins, but rising housing, medical, and travel expenses continue to strain budgets. Many Americans are still feeling the pinch of elevated interest rates, which have driven up borrowing costs for mortgages, auto loans, and credit cards.

The uneven distribution of price changes also means the inflation experience varies widely. For example, urban renters may face steeper housing costs, while rural households might benefit more from falling energy prices.

6. Policy Outlook

The Federal Reserve now faces a delicate balancing act. On one hand, the cooling headline inflation number supports the case for easing monetary policy to avoid stifling economic growth. On the other hand, the stickiness in core inflation, especially in services, argues for maintaining a cautious stance.

Central bank officials will weigh this CPI report alongside upcoming employment data and the September Federal Open Market Committee (FOMC) meeting minutes. The decision could have far-reaching effects not only on interest rates but also on market sentiment and consumer confidence heading into the final quarter of 2025.

Conclusion

July’s CPI data highlights the complex, often conflicting forces shaping the U.S. inflation picture. While the steady headline rate offers reassurance that the worst of the inflationary spike is behind us, persistent core pressures mean the journey back to the Fed’s 2% target isn’t over. For consumers, policymakers, and markets alike, the coming months will be critical in determining whether this steady progress can be maintained without tipping the economy into a slowdown.

No Comments